Facing bankruptcy is the nightmare of every business owner. Entire fortunes, countless hours of hard work, and passionate dreams can all vanish in the blink of an eye. This painful endgame, however, can often be avoided with the right strategies and careful planning. How To Avoid Bankruptcies In Business is more than a goal—it’s a necessity for enduring success.

Here, we explore how you can armor your company against financial turmoil, safeguarding the future you’re working tirelessly to build.

Let’s dive into the proactive steps needed to reduce the risk of bankruptcy and maintain the robust health of your business.

What Proactive Steps Can I Take To Reduce The Risk Of Bankruptcy In My Business?

Business vitality thrives on foresight and prudence. Warding off bankruptcy begins with fundamental strategies that fortify your company’s financial backbone.

One of the key ways to steer clear of financial distress is to diligently monitor cash flow. Regular scrutiny of cash flow statements is like having a health check-up for your business; it allows you to anticipate and tackle shortfalls before they mature into dire straits.

Another strategic move is to diversify revenue streams. You inoculate your business against market swings and industry slumps by not putting all your eggs in one basket. A well-spread income source is a buffer against the unknown.

The adage “cut your coat according to your cloth” is particularly apt when it comes to reducing unnecessary expenses. Streamlining expenses isn’t just about frugality; it’s about smarter operations that keep your business agile and less vulnerable to economic ailments.

Next, smart entrepreneurs manage debt wisely. They understand that debt can be a lever for growth, not just a lifeline in troubled waters. Negotiating favorable debt terms and prioritizing repayment can prevent your business from being hamstrung by high-interest financial obligations.

Lastly, don’t forget to plan for emergencies. A robust contingency fund and risk management plan are your business’s emergency services, ready to respond when unexpected socio-economic tremors hit.

Elaborating on Proactive Measures:

Practice vigilant cash flow monitoring to stay ahead of financial issues:

- Use cash flow forecasts to anticipate and prepare for future financial requirements.

- Analyze cash flow statements monthly or even weekly for a real-time snapshot of financial health.

Leverage the power of income diversification by:

- Exploring new markets or demographics that could benefit from your product or service.

- Adding complementary products or services that appeal to your existing customer base.

Embark on a journey of expense reduction by:

- Conducting regular audits of business expenses to identify and eliminate waste.

- Implementing cost-effective alternatives for your most significant expenditures.

Debt management is crucial; practice it by:

- Using debt for capital improvements or expansion rather than for covering operational shortfalls.

- Refinancing existing debts to terms that match your cash flow abilities.

Ensure you’re primed for the worst with an emergency plan that includes:

- Building an emergency fund to cover at least three to six months of operating expenses.

- Developing a comprehensive risk management strategy that covers all aspects of your business.

To encapsulate, these measures are not a one-time task; they are ongoing commitments to your business’s financial well-being. Regular implementation and revision of these steps keep your business on solid ground, far removed from the pitfalls of bankruptcy.

How Important Is Financial Planning In Preventing Business Bankruptcy?

Without a map, you tread unknown terrain with trepidation. In business, that map is your financial plan. Financial planning is not just important; it’s essential in the fight against business bankruptcy.

A solid financial plan serves as the bedrock for cash flow management. It is the tool that ensures your business isn’t wandering sightlessly into financial oblivion but is equipped to handle its fiscal obligations effectively. Recognizing risks early through financial planning is like having a crystal ball—issues can be addressed at their nascent stage.

Forecasting is another jewel in the crown of financial planning. It gives you the foresight to make calculated moves regarding investments, growth, and cost-saving approaches. Having a financial plan with built-in safety nets, such as emergency funds, means that your business can weather the storm even in a fiscal downpour.

Elaborating on the Importance of Financial Planning:

Proper cash flow management through financial planning entails:

- Regular updates and review of your financial plan to adapt to changing business needs.

- Tight control over accounts receivable to ensure incoming cash flows are timely.

Early risk identification is facilitated by:

- Scanning the market environment and internal business processes for potential financial threats.

- Periodic SWOT analyses to convert potential threats into opportunities before they escalate.

Forecasting future business performance involves:

- Projecting revenue and expenses based on past performance and predicted future trends.

- Utilizing projections to make informed strategic choices about resource allocation and investments.

Creating and maintaining safety nets means:

- Establishing a reserve fund for unexpected economic downturns or personal business challenges.

- Regularly contributing to this fund as an integral part of your financial planning process.

Financial planning translates to a business culture that is both anticipatory and proactive. It’s an attitude that not only avoids bankruptcy but also paves the way for growth and stability.

Can Altering Business Strategies Help Avoid The Path To Bankruptcy, And If So, How?

The ability to pivot is synonymous with business resilience. Altering business strategies can certainly steer your company away from the bankruptcy cliff, provided that change is based on thoughtful analysis and timely execution.

Adaptive business strategies can mitigate financial risks, keeping your enterprise relevant and competitive. Implementing cost-reduction measures, such as operating lean, can help to stop bleeding cash and maintain solvency. Diversifying the playbook can protect against volatility and reduce dramatic fluctuations in financial stability.

To consistently ward off financial woes, you must keep a weather eye on financial statements. This allows for early detection of financial distress and establishes a window for strategic pivots that can prevent the business from faltering.

Elaborating on Adapting Business Strategies:

Implement proactive strategy adaptation by:

- Continuously evaluating market trends and customer feedback to inform strategy changes.

- Engaging in scenario planning to prepare for various market situations and responses.

Apply cost-reduction measures to bolster your financial state:

- Streamline processes to reduce waste and enhance productivity.

- Leverage technology to automate repetitive tasks and save on labor costs.

Safeguard with diversification efforts by:

- Expanding into new markets or developing new products that align with core competencies.

- Forming strategic partnerships that can open up new revenue streams and spread risk.

Utilize regular financial analysis and forecasting to keep ahead:

- Perform quarterly financial reviews to track your progress against strategic goals.

- Use forecasting tools to visualize the potential impact of market changes on your business.

Renegotiate terms with creditors to build stronger relationships and improve cash flow:

- Approach creditors proactively to renegotiate payment schedules if necessary.

- Maintain transparency and communication with creditors to build trust and understanding.

Business strategy is not set in stone; it is dynamic and responsive. Adjusting your approach in response to internal and external changes can mean the difference between a thriving business and one that struggles to stay afloat.

What Are Some Common Warning Signs That My Business Might Be Heading Towards Bankruptcy?

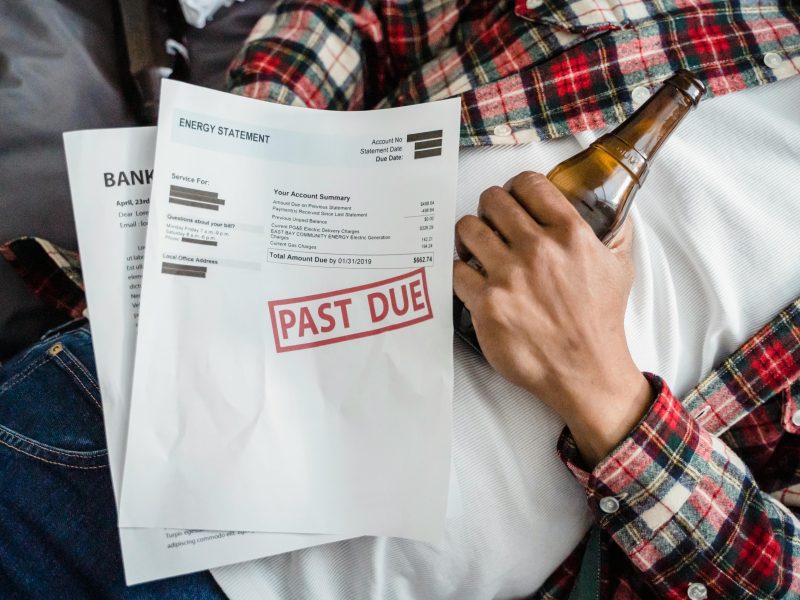

Complacency is the enemy of business health. Heeding the warning signs that herald a possible slide towards bankruptcy can save your business from capsizing. A persistent decrease in profits is like an alarm bell telling you it’s time to reassess your business’s viability.

Cash flow problems are the very definition of a fiscal red flag. A business’s failure to meet its financial commitments indicates deeper issues that, if unaddressed, could lead to bankruptcy. Similarly, a spiraling debt is a treacherous path leading straight into the abyss of financial ruin.

Market position is instrumental to business success. If you notice poor sales and a reduced market share, these are precursors that call for immediate action. Should your company incur legal or collection actions, this signifies that financial distress has reached critical levels, necessitating urgent remedial steps.

Heeding the Warning Signs:

Watch for continuously declining profits as an indication of long-term challenges:

- Re-examine your business model and offerings to identify areas of improvement.

- Look for ways to enhance product or service value to reverse the decline.

Fix cash flow problems to avoid a liquidity crisis:

- Perform a detailed analysis of debtors to improve collections.

- Explore lines of credit or short-term loans to manage cash flow gaps responsibly.

Tackle increasing debt levels head-on:

- Review all current debts and prioritize them based on interest rates and urgency.

- Focus on consolidating and restructuring debts where possible to lower interest rates and monthly payments.

Address poor sales and shrinking market share before it’s too late:

- Delve into market research to understand customer behavior and preferences.

- Reinvigorate your marketing efforts to boost sales and recapture market share.

Respond to legal or collection actions by taking proactive measures:

- Seek legal counsel to understand your options and best course of action.

- Engage with creditors to negotiate repayment plans or settlements.

Watching these signs and acting upon them can prevent your business from sinking into bankruptcy. Recognizing and then weaving these changes into the fabric of your business strategy could not only save your business but also position it for new growth.

Who Can I Consult For Advice If I’m Concerned About My Business’s Financial Stability?

Navigating the complex waters of business finance requires expertise. If you feel the tremors of financial instability beneath your business, seeking professional advice is imperative.

A professional financial advisor can provide you with a meticulous analysis and sound strategic planning. Accountants or certified public accountants (CPAs) ensure that your financial reporting is accurate and that you are on the right side of tax laws.

Should your business display distress signals, a business consultant specializing in turnaround strategies can be a lifeline. Draw on the wisdom of industry mentors or advisory boards for insights that come with experience.

Moreover, small business development centers and economic development agencies can be valuable resources for financial advice and funding opportunities.

Seeking Expertise in Financial Troubles:

Turn to a professional financial advisor for:

- In-depth analysis of your business’s financial health and bespoke strategic financial planning.

- Recommendations on investment opportunities and risk management strategies.

Work with accountants or CPAs to:

- Ensure your business’s financial records are precise and compliant with applicable laws and regulations.

- Get professional assistance in tax planning and optimization to save costs.

Engage a business consultant to:

- Perform a business health check and devise turnaround strategies for distressed businesses.

- Provide guidance on operational efficiencies and cost reductions.

Reach out to industry mentors or advisory boards for:

- Experienced perspectives on financial management and strategic decision-making.

- Networking opportunities and introductions to potential investors or partners.

Utilize development centers and agencies to:

- Access financial assistance programs and grants designed for small businesses.

- Receive counseling on financial planning and management specific to your industry.

Financial stability in business is not assured, but it’s achievable with the right guidance and a proactive approach. Tap into the breadth of knowledge and resources available to guide your business away from the edge of bankruptcy.

Navigating Secure Financial Waters

How To Avoid Bankruptcies In Business is not just about averting disaster; it’s about building a future-proof business. Each step, from monitoring cash flows to seeking expert advice, is a brick in the fortress that will protect your business from the storms of bankruptcy. By embracing sound financial practices and remaining vigilant to warning signs, you give your business the resilience to not only survive but thrive.

This journey of financial stability is continuous, calling for dedication, insight, and the ability to adapt. Your business’s success story doesn’t end with avoiding bankruptcy; it’s just another milestone in a saga of sustainable growth and enduring prosperity.

Please Help Share This Post