Health insurance is one of the most critical investments you can make in life, providing a safety net for when illness or injury strikes. However, the complexity of health insurance plans can overwhelm the selection process. It’s essential to weigh various personal and financial factors to secure a plan that aligns with your needs and budget.

This guide aims to simplify the decision-making process and provide the necessary insights to help you choose the right health insurance plan.

What Factors Should I Consider When Choosing a Health Insurance Plan?

When navigating the intricate world of health insurance, several key factors require careful consideration. Selecting the right plan isn’t just about finding affordable premiums; it’s also about ensuring you have the necessary coverage for your unique healthcare needs.

To begin the process, you should:

- Compare the plan’s premium costs against your budget to ensure it’s financially viable.

- Scrutinise deductible amounts, copayment requirements, and coinsurance rates, as these directly affect out-of-pocket expenses.

- Confirm that your preferred doctors and hospitals are part of the plan’s network to avoid higher costs or the need to change providers.

- Check coverage specifics geared towards prescriptions, procedures, and medical services, particularly those relevant to your current health or foreseeable needs.

- Investigate plan limits, exclusions, claims processes, and customer service reputations to sidestep unforeseen coverage issues and administrative obstacles.

For instance, consider the following:

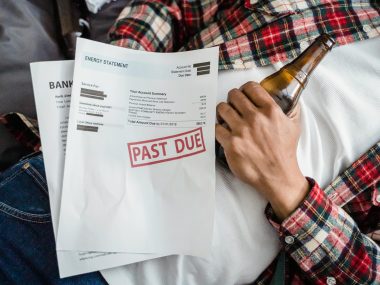

- Premium Costs vs. Budget: Avoid choosing the cheapest plan without adequate coverage.

- Understanding Out-of-Pocket Expenses: Deductibles and copays can vastly differ between plans and impact your finances.

- Provider Network Coverage: Sticking to in-network healthcare providers can be cost-effective.

- Coverage Specifics: Ensure that the treatments you need now—or may need in the future—are covered.

- Limits, Exclusions, and Administrative Aspects: Know any plan limits on procedures or services and understand the claims process.

Each point deserves its own in-depth examination to ensure that there are no surprises when you need to use your coverage.

How Do I Determine the Right Level of Coverage for My Needs?

Identifying the right level of coverage is like fitting a puzzle piece within the broader picture of your health and financial situation. The ‘one size fits all’ approach doesn’t apply here, as everyone has unique health requirements and financial capabilities.

Key considerations should include:

- Your current health status and medical history can indicate future healthcare requirements.

- Regular medications and ongoing treatments pile up costs, making the right coverage essential.

- Assess your financial resilience, honing in on how much you can realistically allocate for health-related expenses.

- The scope and quality of the provider network could make or break your choice if it means sticking with trusted doctors or changing to unfamiliar ones.

- Life isn’t static. Reflect on upcoming changes—like family expansion or overseas trips—that might adjust your health insurance needs.

Let’s elucidate with examples:

- Current Health and Medical History: Regular check-ups, ongoing treatments, or hereditary conditions are factors to consider.

- Prescriptions and Treatments: Plan for common medications and necessary treatments to be covered without straining your budget.

- Financial Situation: Set realistic expectations for premium, deductible, and out-of-pocket costs.

- Provider Network: Stability in healthcare relationships can be vital for continuous care.

- Future Plans: Have a coverage plan that adapts to potential events like having a baby or prolonged travel.

It is through understanding and anticipating your healthcare journey that you can appropriately gauge the level of coverage required.

Can I Change My Health Insurance Plan if My Circumstances Change?

Life is unpredictable, and circumstances change – sometimes when we least expect them to. Thankfully, health insurance policies are built with some flexibility to accommodate such changes.

Here are some important facts to keep in mind:

You’re generally allowed to alter your health insurance plan during the annual open enrollment period.

Experiencing a qualifying life event grants you a special window to make necessary adjustments outside the usual enrollment timeline.

It’s imperative to communicate any life changes to your insurer swiftly to ensure your coverage remains relevant and active.

Ensure you are well-versed in your policy’s terms, as these dictate the permitted timeline and requirements for changing your plan due to life shifts.

Real-life instances include:

- Annual Open Enrollment Adjustments: Use this time to make informed changes to coverage based on the past year’s experiences.

- Qualifying Life Events: Marriage or the birth of a child are perfect examples that warrant a review and possible alteration of your insurance plan.

- Insurance Provider Communication: Keep your insurer in the loop to avoid delays or loss of coverage.

- Policy’s Terms and Conditions: Know your policy, particularly the fine print concerning changes.

By anticipating and understanding these conditions, you can ensure continuous and adequate health coverage throughout life’s twists and turns.

What Is The Difference Between A High Deductible Health Plan (HDHP) And A Preferred Provider Organization (PPO) Plan?

Choosing between an HDHP and a PPO plan is a significant decision, affected by your healthcare needs, financial state, and preferred provider flexibility. Understanding the core differences enables more informed choices that could affect your financial and physical well-being long term.

The main differences to consider are:

- HDHPs offer lower premiums, but this comes at the cost of higher deductibles, indicating you will pay more before your insurance begins to contribute.

- PPO plans are known for their flexibility and comprehensive coverage from the outset, but expect to pay higher premiums for these benefits.

- Those with HDHPs often opt for a Health Savings Account (HSA) to alleviate some of the burdens of higher out-of-pocket expenses using pre-tax savings.

- PPOs don’t usually require referrals to see specialists, allowing quicker and more direct access to necessary medical professionals.

Practical distinctions include:

- HDHPs and Lower Premiums: Suitable if you are generally healthy and want to save on monthly costs.

- PPOs and Provider Choice: Ideal when you want more freedom in choosing healthcare providers or need frequent specialist access.

- HDHPs and HSAs: A synergy that can be beneficial for those comfortable managing higher out-of-pocket costs effectively.

- PPOs and Higher Premiums: might be the right choice for those willing to pay more for immediate, broader coverage.

Your individual circumstances ultimately dictate the most suitable option, balancing costs against coverage and convenience.

A Holistic Approach to Health Insurance Choices

How you choose your health insurance plan is pivotal to managing both your health and your financial future. The selection process is highly personal and should reflect not just your current situation but also potential future healthcare needs and life changes.

Researching, understanding terms, and projecting future needs are vital steps in this critical decision-making process. Remembering that this isn’t just about the numbers—it’s about your peace of mind and well-being—can guide you to the plan that fits just right for you and your family.

By digging more into your healthcare requirements, financial boundaries, and the intricate details of available plans, you arm yourself with the knowledge to make a choice that ensures security, access to necessary care, and financial viability.

Health insurance isn’t just a policy; it’s the assurance that you’ll receive care when you need it the most.

Please Help Share This Post